The Main Principles Of Feie Calculator

Table of ContentsAll about Feie CalculatorFeie Calculator Things To Know Before You Get ThisFeie Calculator Fundamentals ExplainedSome Known Details About Feie Calculator Feie Calculator for Dummies

Initially, he sold his united state home to develop his intent to live abroad permanently and gotten a Mexican residency visa with his other half to assist meet the Bona Fide Residency Examination. Additionally, Neil protected a lasting property lease in Mexico, with strategies to eventually acquire a property. "I presently have a six-month lease on a residence in Mexico that I can expand another 6 months, with the objective to purchase a home down there." Nevertheless, Neil mentions that buying property abroad can be testing without initial experiencing the location."We'll certainly be beyond that. Even if we return to the US for physician's consultations or company phone calls, I doubt we'll invest greater than 1 month in the US in any kind of offered 12-month duration." Neil highlights the relevance of strict monitoring of united state check outs (Digital Nomad). "It's something that individuals require to be actually thorough regarding," he says, and encourages expats to be mindful of common errors, such as overstaying in the united state

The Ultimate Guide To Feie Calculator

tax obligations. "The factor why U.S. taxes on globally revenue is such a big bargain is due to the fact that many individuals forget they're still subject to U.S. tax obligation even after relocating." The U.S. is one of minority nations that tax obligations its residents no matter of where they live, implying that also if an expat has no revenue from U.S.

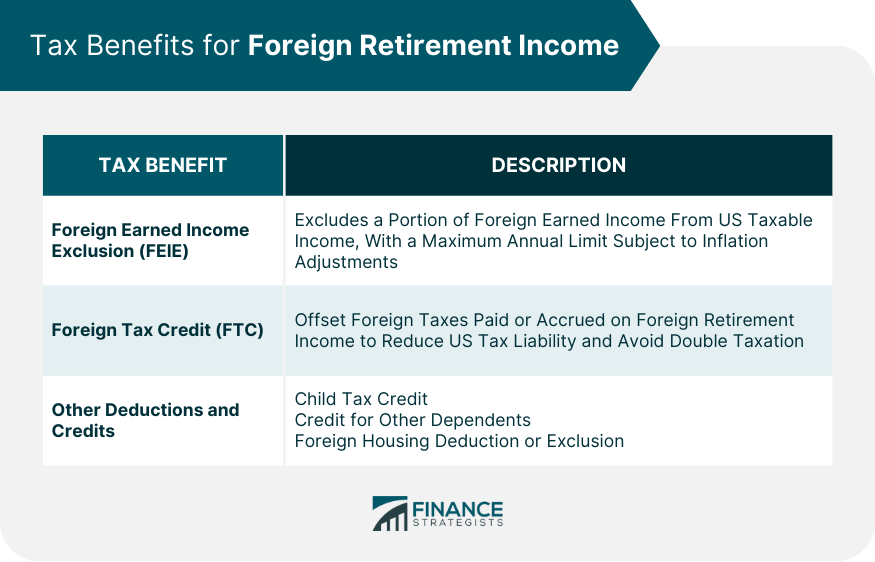

tax return. "The Foreign Tax obligation Credit report enables people working in high-tax countries like the UK to offset their U.S. tax responsibility by the amount they have actually currently paid in taxes abroad," states Lewis. This makes certain that expats are not exhausted twice on the exact same revenue. Those in reduced- or no-tax countries, such as the UAE or Singapore, face added difficulties.

The Ultimate Guide To Feie Calculator

Below are several of one of the most often asked inquiries concerning the FEIE and various other exclusions The International Earned Revenue Exemption (FEIE) allows united state taxpayers to exclude up to $130,000 of foreign-earned revenue from federal earnings tax obligation, reducing their united state tax obligation obligation. To get FEIE, you must fulfill either the Physical Visibility Examination (330 days abroad) or the Bona Fide Residence Test (show your key home in an international nation for an entire tax year).

The Physical Existence Examination needs you to be outside the united state for 330 days within a 12-month period. The Physical Existence Examination additionally requires U.S. taxpayers to have both a foreign income and a foreign tax obligation home. A tax home is specified as your prime area for company or work, despite your household's house.

Getting My Feie Calculator To Work

A revenue tax obligation treaty in between the U.S. and an additional country can assist prevent dual taxes. While the Foreign Earned Earnings Exclusion minimizes taxed revenue, a treaty might give fringe benefits for eligible taxpayers abroad. FBAR (Foreign Bank Account Report) is a needed declare U.S. citizens with over $10,000 in international monetary accounts.

Eligibility for FEIE depends on conference specific residency or physical presence examinations. He has over thirty years of experience and currently specializes in CFO solutions, equity compensation, copyright taxation, cannabis tax and divorce relevant tax/financial preparation matters. He is a deportee based in Mexico.

The international made income exclusions, occasionally referred to as the Sec. 911 exclusions, omit tax on earnings gained from working abroad. The exemptions comprise Bona Fide Residency Test for FEIE 2 parts - an earnings exclusion and a real estate exclusion. The adhering to Frequently asked questions go over the benefit of the exemptions consisting of when both spouses are expats in a basic fashion.

The 10-Minute Rule for Feie Calculator

The tax advantage omits the earnings from tax obligation at bottom tax rates. Formerly, the exemptions "came off the top" lowering earnings topic to tax at the top tax obligation rates.

These exemptions do not excuse the salaries from United States taxation however merely provide a tax obligation reduction. Keep in mind that a single person working abroad for every one of 2025 who earned about $145,000 without any various other earnings will certainly have taxable earnings minimized to absolutely no - efficiently the very same solution as being "free of tax." The exclusions are calculated each day.

Comments on “About Feie Calculator”